|

|

|||||||

| Coffee Shop Talk of a non sexual Nature Visit Sam's Alfresco Heaven. Singapore's best Alfresco Coffee Experience! If you're up to your ears with all this Sex Talk and would like to take a break from it all to discuss other interesting aspects of life in Singapore, pop over and join in the fun. |

|

|

|

Thread Tools |

|

#1

|

|||

|

|||

|

An honorable member of the Coffee Shop Has Just Posted the Following:

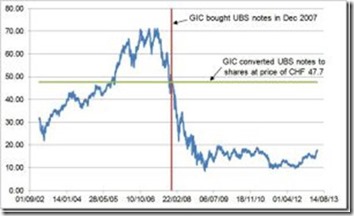

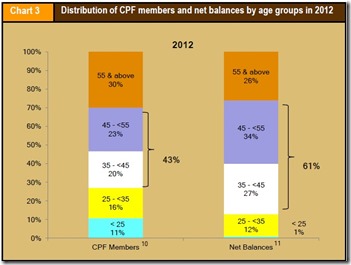

Source: likedatosocanmeh blog 20140515 How our CPF Ponzi scheme will end in tears for CPF members May 15, 2014 The CPF was originally introduced by the British colonial authority in 1955 as a compulsory savings scheme to allow workers to save for retirement. Since the PAP took over the CPF after independence, there have been thousands of tweaks in order to satisfy PAP’s insatiable greed. The CPF system has been complicated to the extent that it now resembles more of a Ponzi scheme. How a Ponzi scheme works Wikipedia defines a Ponzi scheme as “a fraudulent investment operation where the …organisation (CPF board) pays returns to its investors (CPF members) from new capital (CPF new members’ funds) paid to the operators (GIC) by new investors (new CPF members). Similar to a Ponzi scheme, CPF investments are shrouded in secrecy; the government has also repeatedly refused to disclose where CPF funds are invested and their market values. GIC’s opacity creates suspicions of huge CPF losses CPF funds are invested in GIC. As a government investment arm, GIC appears to be punting the share market and picking market bottoms during financial crises. One of the more well known bigger losses is its investment in UBS during the subprime crisis. GIC has been sitting on huge paper losses in the UBS investment. What GIC does is it selects from a pool of fund managers (tikam tikam) and provides them with OUR money for ‘investment’. Its board of directors comprises politicians and civil servants, hardly anyone with experience in fund management.  GIC has been criticised by none other than MM Lee Kuan Yew who said that it had “bought too early into global banks such as Citigroup and UBS”. How GIC invests with our CPF monies What GIC essentially does is to invest come rain or shine ie market up or down doesn’t matter because it has a steady stream of funds coming in. For investments which are ‘underwater’, it will classify them as “long term investments”. Paper losses are not booked and nobody will know. Mandating perpetually higher CPF MS creates even more suspicions CPF members have become increasingly suspicious of the hidden government agenda in raising the Minimum Sum. The MS for the Ordinary and Medisave Account stands at $155,000 and $43,500 respectively. This is an amount where only 1 in 8 Singaporeans have. For 2014, the combined MS for the OA and MA is $198,500. In 20 years time, the MS from today’s $198,500 will be $434,937 at a 4% inflation rate, $526,679 at 5% and $636,616 at 6%. Future value calculator Since an increasing number of CPF members will not be able to meet the MS requirement, the government appears to have a hidden agenda. Not just masking GIC losses but to prevent withdrawal tsunami by baby boomers and PRs leaving  One reason to increase the MS drastically may be to mask GIC losses. Another would be to prevent the largest outflow in CPF history. From the chart above, 34% or $78.2 billion of CPF funds belong to members aged between 45 and 55. Due to the high cost of living, an average of 10,000 PRs have given up their permanent residency since 2000, bringing their CPF monies home of course. The PAP has to act to stem the mother of all CPF outflows or it will be catastrophic for GIC. GIC urgently needs a steady stream of capital in order to make a few killings in the stock market to make up for other investment losses. New investments will also provide a breather as total dividends will increase to supplement our budget surplus. Younger Singaporeans must be wary, older ones played out by PAP and CPF policy Conservatively using an inflation rate of only 4%, CPF members will be required to have a MS of $526,679 in 20 years time. After meeting our housing needs, only wealthy Singaporeans will be able to meet the MS requirement. This confirms: - Singapore to be the most expensive place to retire in the world. - The PAP has abdicated its basic responsibility of taking care of our healthcare needs with its ever increasing Medisave Minimum Sum. - The PAP is incompetent – instead of helping Singaporeans to retire comfortably, it is basically telling us to continue helping ourselves by working longer and accepting lower wages. CPF members must reject GIC’s crap The MOF states that “GIC is a professional fund management organisation” and a “fairly conservative investor”. GIC invests CPF monies in stocks, private equity, real estate, bonds, etc in order to generate returns. Although the MAS and Temasek publish the size of their managed funds, GIC does not. To defend GIC’s opacity, the MOF says the publication will “make it easier for markets to mount speculative attacks on the Singapore dollar during periods of vulnerability”. This is crap. Question: Since when was GIC tasked with the defence of the Singapore dollar? No other country manages public funds in such an opaque manner. What is GIC hiding from CPF members? MPs’ collective silence on CPF a troubling sign Other issues like housing, education, public transportation, etc. may affect different segments of the population but CPF affects EVERYONE. It is expected of PAP MPs not to act in the interests of citizens in Parliament but why are opposition MPs also silent? Are CPF losses so huge that could foreign investors’ confidence will be affected by such a disclosure? CPF not Ponzi scheme because previously all members were paid When it comes to investing, history lovers should take note that “past performance is no guarantee of future results”. Ponzi schemes usually start off well and the problem is at the tail end where redemptions occur. The reason why CPF was able to pay all its members in full upon reaching 55 was the increasing support of new members. Presently, the rate of increase in the number of CPF members and also the CPF amounts have declined. Changes in immigration policy will also have an effect. The PAP is trying to prevent CPF withdrawals leading to a net reduction in GIC assets ie sell its investments in the open market to pay CPF members. From a paper loss, GIC’s losses will then be realised and reported. PAP must prevent such disclosures at all costs. Ponzi schemes ultimately collapse because of redemption (withdrawal) Bernard Madoff Ponzi scheme, the biggest financial fraud in US history, unraveled because of a $7 billion redemption. Without the redemption, Madoff would not have been caught. Redemptions are equivalent to withdrawals in CPF. CPF faces a similar situation where the mother of all withdrawals (redemption) is at its doorstep. What makes it so different from the Madoff case is that the government is able to change the rules of the game at its whim by mandating more funds for GIC. The only way for for GIC to get caught with its pants down is to have all its books opened. With the PAP’s overwhelming presence in parliament, this is not likely to happen any time soon. Summary Our CPF system has morphed into a sort of Ponzi scheme. CPF members are most concerned by the total lack of transparency. The government creates even more suspicions by mandating a perpetually higher CPF Minimum Sum. Again, the issue of transparency arises because there was no parliamentary debate. The issue of transparency features prominently in a Ponzi scheme. The Ponzi CPF scheme will come to light with the mother of all withdrawals ie $78 billion is held by those aged between 45 and 55 in 2012. The PAP has attempted to prevent this at all costs. Young ordinary citizens must know that at the rate of increase, the MS will be more than $500,000 in 20 years time. They will not be able to meet this ridiculous requirement. When ALL MPs have ignored the CPF elephant in the room, their collective silence is a troubling sign. Is GIC too big to fail? Increasing the population to bring in new CPF members to support the scheme has a limit. In its current form, the CPF system is nothing but a Ponzi scheme designed to benefit the PAP and is severely detrimental to ordinary citizens’ interests. It can drag on for years but will ultimately collapse and end in tears for CPF members. P S “CPF members will be required to have a MS of $526,679..” – correct figure should be “$434,937″. “$526,679″ is for 5% inflation rate. Click here to view the whole thread at www.sammyboy.com. |

| Advert Space Available |

|

| Bookmarks |

|

|